Executive Summary

This comprehensive analysis examines Xiaomi Corporation's business model, financial performance, competitive positioning, and stock price potential through 2027. Founded in 2010, Xiaomi has evolved from a smartphone manufacturer to a diversified technology company with significant operations in IoT devices, internet services, and electric vehicles.

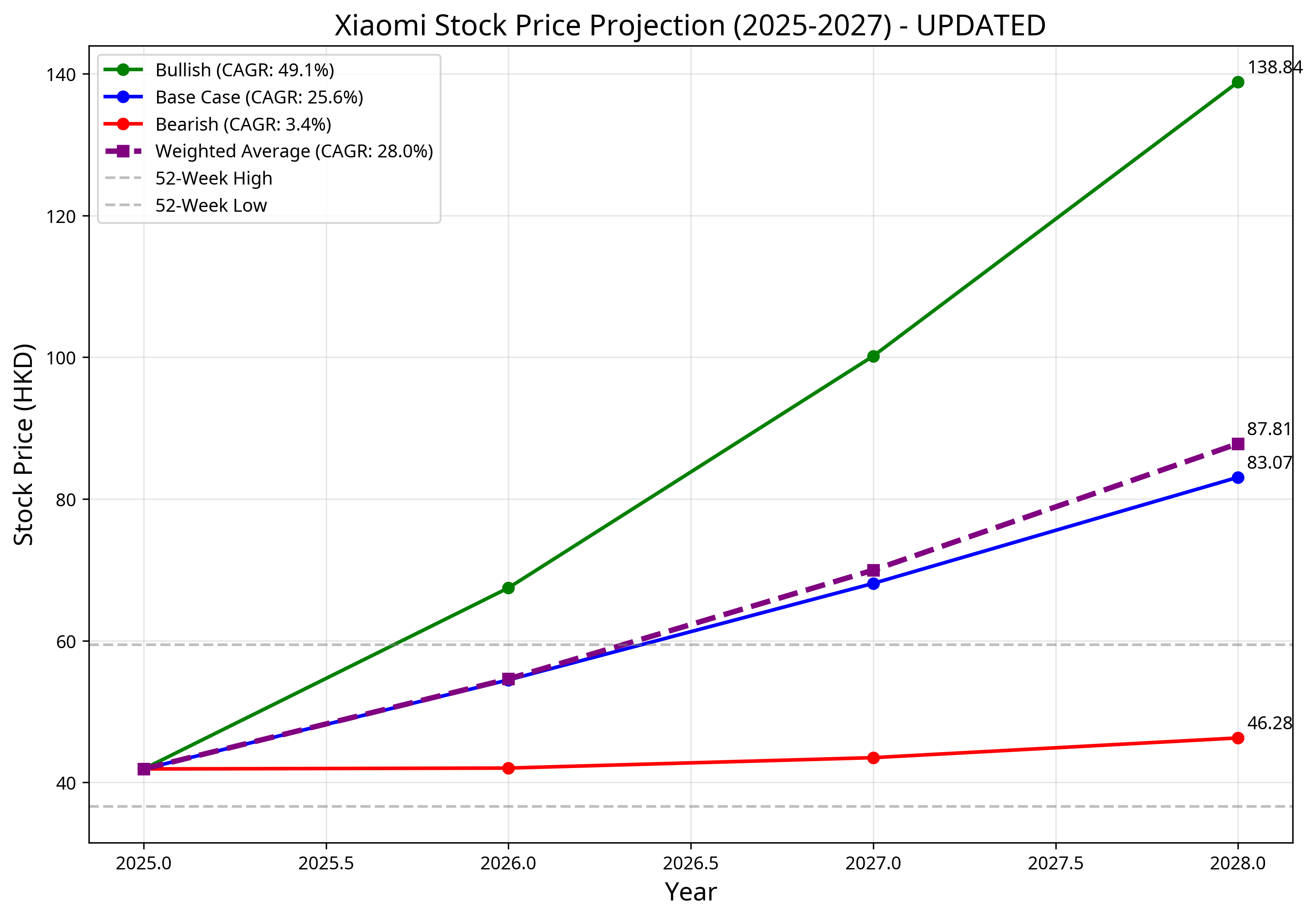

Our analysis indicates that Xiaomi's stock (1810.HK) has substantial growth potential, with a weighted average price target of HKD 87.81 by 2027, representing a 109.6% return from the current price of HKD 41.90 (April 2025).

Key Investment Considerations:

- Diversified Revenue Streams: Xiaomi has successfully expanded beyond smartphones into IoT, internet services, and electric vehicles, creating multiple growth vectors

- Electric Vehicle Opportunity: The company's entry into the EV market represents both a significant growth opportunity and execution risk

- Premiumization Strategy: Ongoing efforts to move upmarket are improving profit margins while maintaining the company's value proposition

- Geopolitical Risks: US-China trade tensions and technology export restrictions pose significant challenges to global operations

- Strong Financial Position: Robust cash reserves and improving profitability provide flexibility to navigate challenges and invest in growth

Stock Projection Summary

Company Background

Founding and Evolution

Xiaomi Corporation was founded in April 2010 by Lei Jun and a team of co-founders with a vision to create "amazing products with honest prices." The company initially focused on developing a custom Android-based operating system called MIUI before launching its first smartphone in 2011.

The company's name, Xiaomi (小米), translates to "millet" in Chinese, reflecting the company's initial philosophy of starting small and growing incrementally. The "MI" in its logo also stands for "Mobile Internet" and "Mission Impossible," representing the company's ambitious goals despite challenging market conditions.

Growth Trajectory

Xiaomi experienced rapid growth in its early years, becoming China's largest smartphone company by 2014 and one of the world's most valuable technology startups with a valuation of $45 billion in 2014. The company expanded internationally, first to neighboring Asian markets and later to Europe, Latin America, Africa, and the Middle East.

In July 2018, Xiaomi completed its initial public offering on the Hong Kong Stock Exchange, raising $4.7 billion at a valuation of approximately $54 billion. While this was below the initially targeted $100 billion valuation, it still represented one of the largest tech IPOs of that year.

Current Position

Today, Xiaomi is one of the world's leading technology companies with a comprehensive "Human x Car x Home" smart ecosystem. The company ranks among the top three smartphone manufacturers globally, with a market share of 13.8% as of Q3 2024.

Key Product Categories

- Smartphones: Core business with growing premium segment presence

- Smart Home Devices: Leading global provider of smart TVs, air purifiers, and other connected home products

- Wearables: Among the top global manufacturers of fitness bands and smartwatches

- Electric Vehicles: Emerging player in the premium EV segment with the Xiaomi SU7 series

- Internet Services: Growing ecosystem of apps and services with 685.8 million global monthly active users

Stock Performance Analysis

Historical Performance

Xiaomi's stock has demonstrated significant volatility since its 2018 IPO, influenced by factors including smartphone market cycles, US-China relations, COVID-19 pandemic impacts, Chinese regulatory environment, and new business initiatives like electric vehicles.

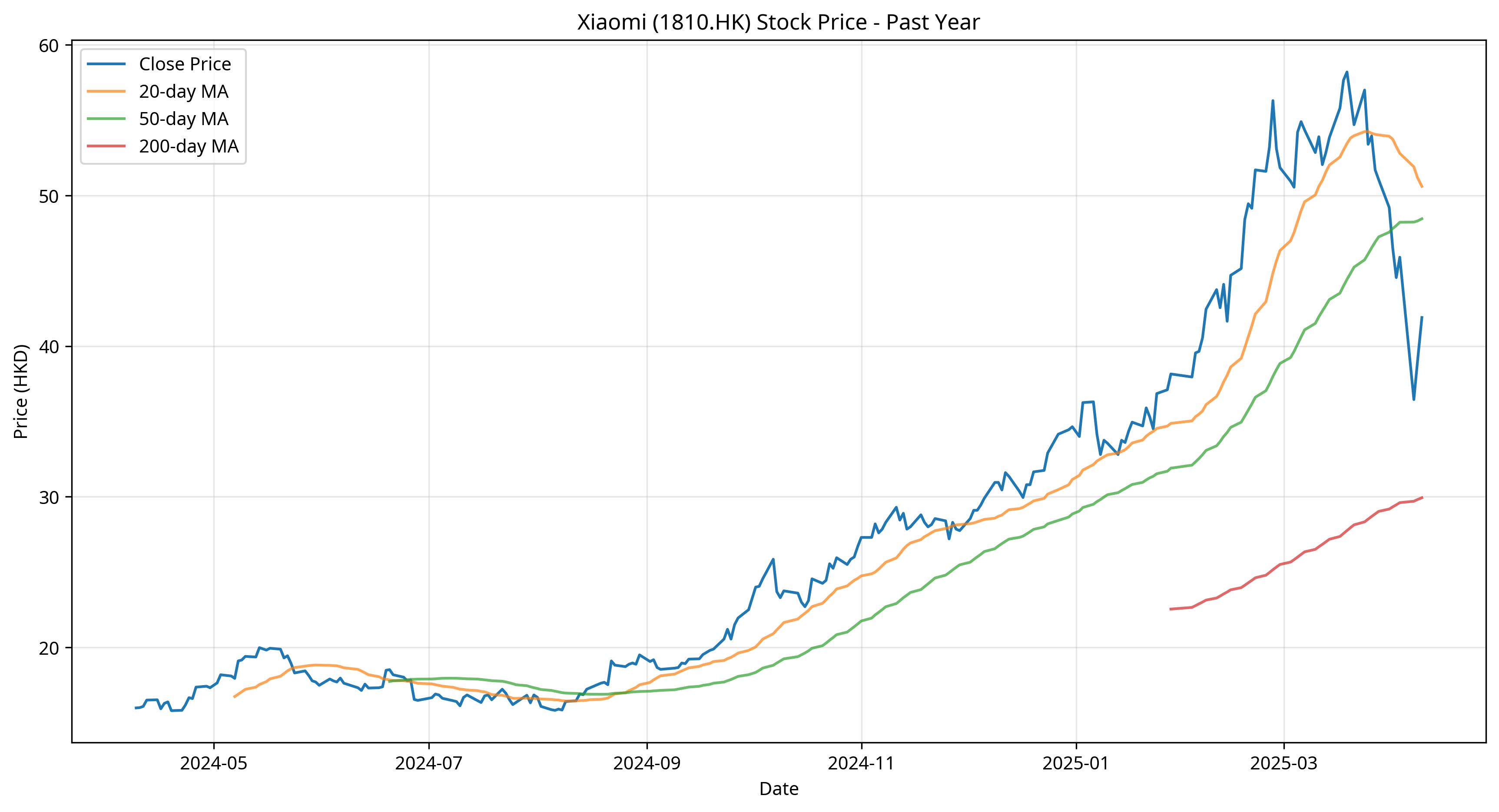

Over the past year, Xiaomi's stock has traded in a range of HKD 36.60 to HKD 59.45, with significant price movements corresponding to quarterly earnings releases, geopolitical developments, and new product announcements.

Technical Indicators

- Support Levels: Strong support around HKD 36.00, tested multiple times in the past year

- Resistance Levels: Key resistance at HKD 60.00, representing previous all-time highs

- Moving Averages: Currently trading above both 50-day and 200-day moving averages, indicating positive momentum

- Relative Strength: Outperforming the broader Hang Seng Index over the past six months

- Volume Patterns: Increasing trading volumes on positive price movements, suggesting institutional accumulation

Valuation Metrics

| Metric | Xiaomi | Industry Average |

|---|---|---|

| P/E Ratio | 22.5x | 18.7x |

| Price-to-Sales | 1.8x | 1.5x |

| EV/EBITDA | 15.3x | 12.8x |

| Price-to-Book | 3.2x | 2.7x |

The premium valuation relative to industry peers reflects investor optimism about Xiaomi's growth prospects, particularly in electric vehicles and IoT expansion, balanced against geopolitical and execution risks.

Business Model Analysis

Revenue Streams

Xiaomi has established a diversified business model with four primary revenue segments:

Smartphone Business

51.4% of Revenue

- RMB47.5 billion in Q3 2024

- 13.9% year-over-year growth

- Top three global brand for 17 consecutive quarters

- Increasing premium segment penetration

IoT and Lifestyle

28.2% of Revenue

- RMB26.1 billion in Q3 2024

- 26.3% year-over-year growth

- Record high 20.8% gross margin

- Smart TVs, wearables, home appliances

Internet Services

9.2% of Revenue

- RMB8.5 billion in Q3 2024

- 9.1% year-over-year growth

- 77.5% gross profit margin

- 685.8 million global monthly active users

Electric Vehicles

10.5% of Revenue

- RMB9.7 billion in Q3 2024

- 17.1% gross profit margin

- 39,790 vehicles delivered in Q3 2024

- 100,000 vehicle production milestone in Nov 2024

Competitive Advantages

Ecosystem Strategy

The company has successfully created a comprehensive "Human x Car x Home" smart ecosystem that integrates smartphones, IoT devices, and electric vehicles. This ecosystem approach creates synergies between product lines, increases customer loyalty, and generates multiple revenue streams from the same customer base.

Efficient Cost Structure

Xiaomi maintains competitive pricing through keeping products in the market for longer periods, optimizing manufacturing costs, using flash sales and inventory optimization, and maintaining thin hardware margins while generating revenue from services.

Direct Sales Model

The company leverages both online and offline channels through direct-to-consumer e-commerce platforms that reduce intermediary costs, expanding physical retail presence, and an omnichannel approach that maximizes market reach.

Innovation and R&D Focus

Xiaomi invested RMB6.0 billion in R&D in Q3 2024 (up 19.9% YoY), employs 20,436 R&D personnel, holds over 41,000 patents worldwide, and has improved its ranking in 5G Standard Essential Patents to 8th globally.

Financial Performance

Risks and Opportunities Analysis

Key Risks

Electric Vehicle Business Risks

- Profitability timeline of "a couple of years" according to Fitch Ratings

- Production scaling challenges in competitive market

- Chinese EV market saturation with domestic and international competitors

- Regulatory uncertainties regarding EV subsidies

Competitive Pressures

- Intense smartphone competition from established players

- Price wars eroding profit margins in core markets

- Limited presence in high-margin premium smartphone segment

- Increasing competition in smart home and IoT space

Supply Chain Vulnerabilities

- Reliance on external manufacturers for key components

- Vulnerability to global chip shortages or supply disruptions

- Geographic concentration of manufacturing

Geopolitical and Regulatory Risks

- US-China tensions impacting global operations

- Technology export restrictions limiting access to components

- Intellectual property challenges in international markets

- Evolving global data privacy regulations

Key Opportunities

IoT Ecosystem Expansion

- IoT segment highlighted by Fitch as key driver of future cash flow

- Ecosystem synergies creating cross-selling opportunities

- Rising consumer adoption of smart home technologies

- Strong position in growing wearables market

Geographic Expansion

- Growth opportunities in Latin America, Middle East, Africa, and Southeast Asia

- Expanding presence in European markets

- Growing offline retail presence complementing online sales

- Increasing global brand awareness

Premium Segment Penetration

- Ongoing efforts to move upmarket with higher-end devices

- Brand perception improvement from successful EV launch

- Increasing market share in higher price segments in China

- Improved profitability through higher-margin premium products

Electric Vehicle Business

- Strong initial reception of Xiaomi SU7 models

- Leveraging existing technological expertise

- Brand extension reinforcing technology credentials

- Deep integration between EVs and broader smart device ecosystem

US-China Geopolitical Factors

Current US-China Trade Relations

Escalating Tariffs

Trade relations between the US and China have deteriorated significantly since President Trump's inauguration in January 2025, with tariffs on Chinese goods escalating from 10% in February to a staggering 104% by April 2025.

Impact on Chinese Markets

- Hang Seng Index dropped more than 20% from its March 19, 2025 peak

- Chinese offshore yuan plunged to record lows against the US dollar

- Xiaomi was among the worst performers with a 20.9% drop in a five-day period

Technology Export Restrictions

Semiconductor and Advanced Technology Controls

- Multiple rounds of export controls targeting China's semiconductor industry

- March 2025 restrictions on Chinese tech firms buying American chips

- Extensive regulatory tools restricting data flows to China

- Draft rules to ban Chinese autonomous cars and restrict drones

Implications for Xiaomi

Direct Business Impacts

- 104% tariff increases cost of US-exported products

- Semiconductor restrictions affecting component access

- Market access limitations for connected devices

- R&D constraints from limited technology access

Strategic Responses

- Accelerating expansion in non-US markets

- Developing alternative supply chains

- Increasing indigenous technology R&D

- Shifting focus to products less affected by restrictions

Stock Price Projection (2025-2027)

Methodology

Our stock price projections are based on a comprehensive financial model that incorporates:

- Historical financial performance and growth trends

- Industry benchmarks and competitive positioning

- Scenario analysis with probability weighting

- Sensitivity analysis of key variables

- Geopolitical risk assessment

Scenario Analysis

Bullish Scenario (25%)

Key Assumptions:

- Revenue Growth: 35% (2025), 30% (2026), 28% (2027)

- Profit Growth: 40% (2025), 35% (2026), 32% (2027)

- P/E Ratio Change: 1.15x (2025), 1.10x (2026), 1.05x (2027)

Drivers:

- Strong growth in all segments, particularly EV and IoT

- Successful premiumization strategy

- Easing of US-China trade tensions

- Expanded global market share

Base Case Scenario (50%)

Key Assumptions:

- Revenue Growth: 25% (2025), 22% (2026), 20% (2027)

- Profit Growth: 30% (2025), 25% (2026), 22% (2027)

- P/E Ratio Change: 1.0x (stable)

Drivers:

- Moderate growth across all segments

- EV business reaches profitability by 2027

- Stable but persistent US-China tensions

- Continued market share gains in emerging markets

Bearish Scenario (25%)

Key Assumptions:

- Revenue Growth: 15% (2025), 12% (2026), 10% (2027)

- Profit Growth: 18% (2025), 15% (2026), 12% (2027)

- P/E Ratio Change: 0.85x (2025), 0.90x (2026), 0.95x (2027)

Drivers:

- Slower growth due to increased competition

- EV business faces profitability challenges

- Escalation of US-China tensions

- Supply chain disruptions

Sensitivity Analysis

Key Stock Price Drivers

-

Electric Vehicle Business Performance

- Profitability timeline and market share gains

- Integration with broader Xiaomi ecosystem

-

Smartphone Market Position

- Premium segment penetration success

- Global market share trends

-

IoT and Lifestyle Products Growth

- Ecosystem expansion and user base growth

- Margin improvement in this segment

-

Geopolitical Factors

- US-China trade relations and tariff levels

- Technology export restrictions impact

-

Financial Performance

- Revenue growth sustainability

- Profit margin expansion

Investment Recommendation

Based on our comprehensive analysis, we believe Xiaomi represents an attractive investment opportunity for investors with a medium to long-term horizon. The weighted average price target of HKD 87.81 by 2027 represents a potential return of 109.6% from the current price of HKD 41.90, translating to a compound annual growth rate of 28.0%.

Investment Thesis

- Diversified Growth Engines: Xiaomi's expansion beyond smartphones into IoT, internet services, and electric vehicles provides multiple avenues for growth

- Ecosystem Strategy: The "Human x Car x Home" ecosystem creates competitive advantages and customer lock-in

- Premiumization Opportunity: Ongoing efforts to move upmarket should improve profit margins while maintaining the company's value proposition

- Financial Strength: Strong cash position provides flexibility to navigate challenges and invest in growth initiatives

- Valuation Upside: Current valuation does not fully reflect the potential of the EV business and ecosystem expansion

Risk Factors to Monitor

- Escalation of US-China trade tensions

- Semiconductor supply chain disruptions

- EV market competition and profitability challenges

- Smartphone market saturation

- Regulatory changes in key markets

Investor Suitability

This investment is most suitable for:

- Growth-oriented investors with a 2-3 year time horizon

- Investors comfortable with above-average volatility

- Portfolios seeking exposure to emerging technology trends and Chinese consumer markets

- Investors who can tolerate geopolitical risks

Conclusion

Xiaomi Corporation has successfully transformed from a smartphone manufacturer to a diversified technology company with a comprehensive ecosystem spanning smartphones, IoT devices, internet services, and electric vehicles. The company's strong financial performance, innovative business model, and strategic initiatives position it well for continued growth despite significant geopolitical headwinds.

Our analysis projects a weighted average stock price of HKD 87.81 by 2027, representing a potential return of 109.6% from current levels. While risks related to US-China tensions, competitive pressures, and execution challenges remain significant, we believe Xiaomi's diversified business model, strong domestic market position, and financial resources provide important buffers against these challenges.

Investors should closely monitor developments in US-China relations, particularly regarding technology export controls and connected device regulations, as these will have outsized impacts on Xiaomi's long-term growth trajectory and valuation. The company's strategic responses to these challenges, including market diversification, supply chain localization, and R&D investments, will be key indicators of its resilience and adaptability in this challenging geopolitical environment.